Why Does 70% of all US Startup Investment Happen in Only 20% of the Country?

Mihir Gandhi

America accounts for about two thirds of all global venture capital activity. Europe comes in at a very distant second, with around 15%. However, within the U.S. itself, some states fare significantly better in securing startup funding than others.

Silicon Valley, in California, dominates, followed by Boston (Massachusetts), Seattle, (Washington) Austin (Texas), Denver (Colorado) and New York (New York). But even in the Big Apple, there are only about a fifth of the startups per capita compared to Silicon Valley.

What makes startups in these cities do better than anywhere else in the country? And why do they attract so many investment dollars? While no one can actually come up with a definitive reason, there are a number of factors contributing to this interesting phenomenon.

Silicon Valley, for example, is known as the hub for high-tech startups. According to the Halo Report, mobile and Internet startups (together with healthcare) accounted for almost 80% of angel investment in 2013. Experts in these industries thus naturally tend to gravitate to the area, bringing with them their expertise, innovative thinking and ideas. These things in turn attract investment. Supporting industries spring up around idea hubs, encouraging more growth and thus more investment. Suddenly everyone in the area is in the same business.

Hope for Other States

In 2011, the National Venture Capital Association cited only four states – California, Massachusetts, New York and Texas – as having broken the $1 billion mark in VC investment. Since then, however, other states are starting to catch up just a little.

Oklahoma City, for example, was voted the best place to launch a small business in 2013, according to NerdWallet – up from 5th place in 2012. Investment is encouraged by the city’s comparatively low income tax, and low cost of living. In addition, getting a business started is easy – applications can be done online, and the entire process completed in a morning.

While the rest of the country still has a long way to go to catch up with the amount of startup investment flooding into California, it’s obvious that there is potential for growth in many other US states as well - an encouraging sign for our laboring economy.

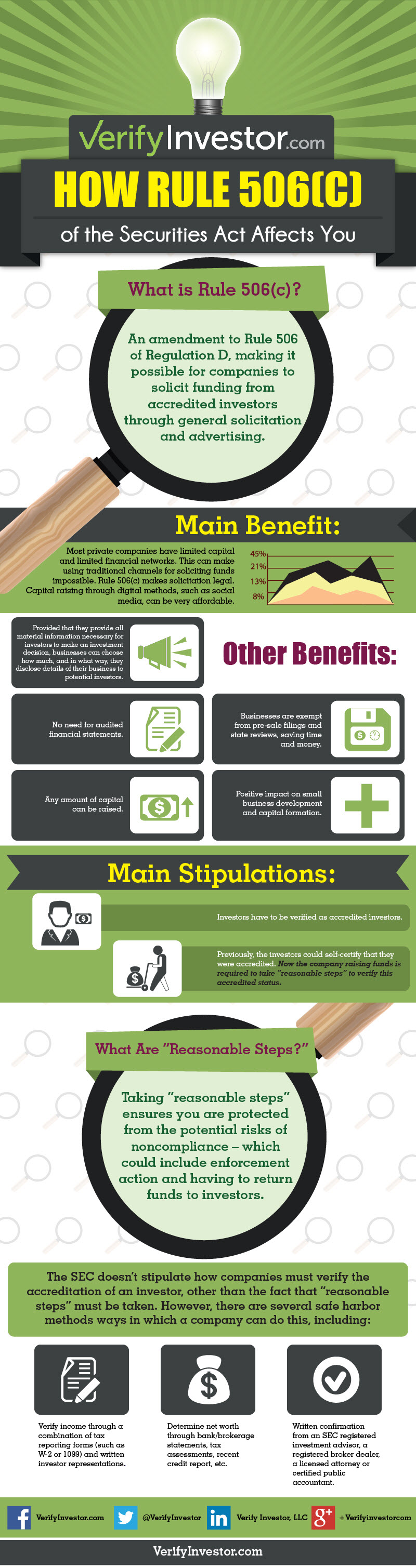

Certain types of offerings require that investors be verified as accredited investors. To learn more, visit VerifyInvestor.com.