This article was written by Jor Law and originally published in http://www.rule506investor.com/

Introduction

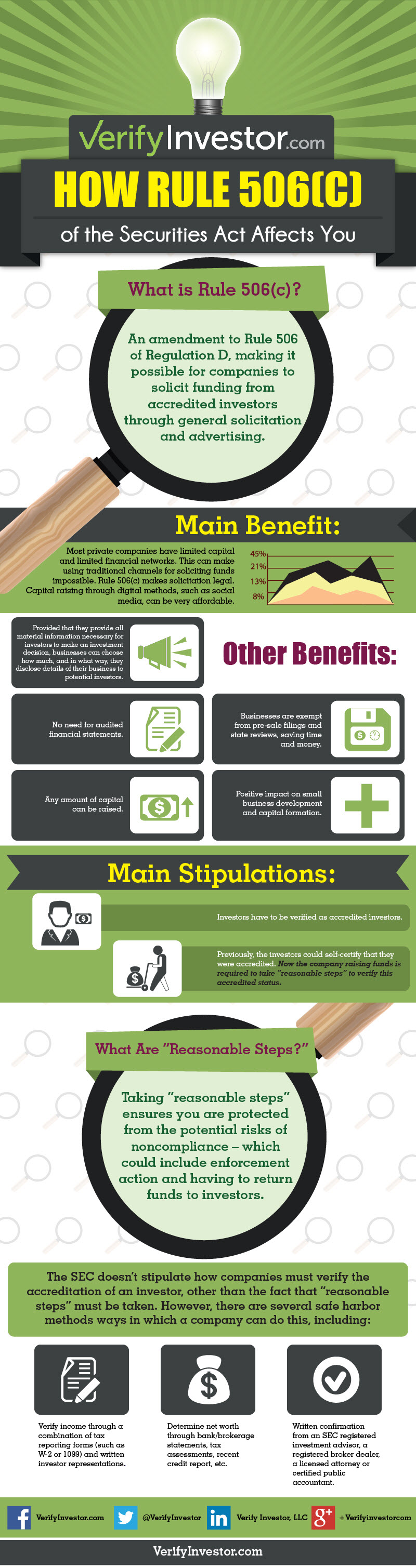

When companies raise capital by selling securities, they must comply with securities laws. One of the key requirements is that the securities be registered with the Securities and Exchange Commission (SEC) – it’s a costly and time-intensive process. For that reason, most companies opt not to register or qualify the securities they plan to offer or sell and seek an exemption from the laws instead. In the United States, the most commonly used exemption has been Rule 506 of Regulation D. Historically, an offering conducted under Rule 506 would be deemed to be a non-public offering which was afforded more lenient treatment under the laws. However, that meant that a company couldn’t generally solicit or advertise the capital raise.

The decades-old ban on general solicitation, however, was lifted on September 23, 2013 when the SEC added new Rule 506(c) to Regulation D. This action was mandated by Title II of the Jumpstart Our Business Startups Act (JOBS Act), which required the SEC to remove the ban on the use of general solicitation by companies seeking to conduct a private placement so long as certain requirements are observed. The key requirement—issuers taking advantage of generally soliciting a “private” offering must take “reasonable steps” to verify that all of their eventual investors are “accredited investors.”

What is an Accredited Investor?

The definition of “accredited investor” is found in Rule 501 of Regulation D. Certain investors, such as banks or insurance companies are accredited simply due to the type of investor they are. Other investors are accredited only if they have minimum assets exceeding a certain amount (e.g., $5 million for charitable organizations, corporations, or partnerships). Individual investors can be accredited simply because they are a director, executive officer, or general partner of the company selling securities, or they can be accredited by way of minimum income (income exceeding $200,000 in each of the two most recent years or joint income with a spouse exceeding $300,000 for those years and a reasonable expectation of the same income level in the current year) or minimum net worth (individual net worth, or joint net worth with the person’s spouse, that exceeds $1 million at the time of the purchase, excluding the value of the primary residence of such person). The SEC has a good information page on accredited investors at the following link: http://www.sec.gov/answers/accred.htm

Why Verify?

Even before the advent of Rule 506(c), most issuers only targeted accredited investors due to the fact that the requirements for taking on unaccredited investors were more onerous. Under the old Rule 506 (now known as Rule 506(b)) that existed before Rule 506(c) was made available, investors could fill out a questionnaire certifying themselves as accredited investors. Companies did not need to actually take additional steps to verify the accredited investor status. With the new Rule 506(c), companies can now generally solicit and advertise their capital raise to anybody so long as they verify that the only people that actually invest are accredited investors – the rationale being that accredited investors either can better comprehend the risks of their investment and/or be able to bear a loss of their investment. Verification has to be done by taking “reasonable steps.” In the final rules that became effective on September 23, 2013, the SEC outlined what would constitute reasonable steps. You may access the final rules through the following link: http://www.sec.gov/rules/final/2013/33-9415.pdf From time to time, the SEC issues interpretive releases that give additional insight into how to properly verify accredited investors.

Many companies have been advised by their lawyers to not verify investors themselves. It’s too tedious of a process, requires specialized knowledge of the securities laws, and carries too high of a liability if done incorrectly. Instead, companies are recommended to outsource this function to third-party verification providers – but not just any random third-party. It’s important to choose a verification provider that is qualified and one that will protect the confidential nature of the information they will receive in order to conduct the review. In fact, the SEC indicates that a company may rely on a third party verification provider only if it “has a reasonable basis to rely on such third-party verification.”

Questions to ask your Third-Party Accredited Investor Verification Provider

Whether you’re seeking to verify the accredited investor status of an investor, or an investor seeking to (or being asked to) undergo the verification process, you ought to do some homework first. After all, you don’t just want to trust your legal compliance and information or your investor’s information to the wrong folks. Here are some questions you may want to ask:

How does your verification process work, and how can you be sure that it is legally compliant?

The SEC has given very clear guidelines on what it believes reasonable steps are. While they do provide the ability for someone to verify using a “principles-based” method which allows one to conduct verification based on a determination by the issuer based on the context of the particular facts and circumstances, they also provide some guaranteed safe harbors for verification. Where possible, your third-party verifier should be using the safe harbor methods of verification and not take unnecessary risks. Make sure that your securities attorney or compliance officer is comfortable with how your verification company conducts its verifications.

Are your verifications conducted by a licensed attorney? What experience do the verifiers have, and are they properly trained?

A verification properly conducted by a licensed attorney, accountant, broker-dealer, or investment advisor constitutes reasonable steps when accompanied by written confirmation that meets the SEC’s requirements. Although non-licensed individuals could perform the verification, there is potential liability there. Note that while the SEC mentions that the verifications could be done by any of the aforementioned licensed professionals, it’s important to note that many of the might actually not be qualified to conduct the reviews. Even most attorneys are not adequately familiar and up-to-date with the securities laws to properly conduct the reviews. Don’t take chances and insist that all verifications be done by a licensed attorney that is experienced and properly trained to perform the verifications. After all, if most lawyers don’t understand the verification laws well enough, how would non-attorneys?

Can you handle all types of accredited investor categories, not just individual investors but also entity investors? Can you handle accreditation of foreign investors?

It’s hard enough to find investors – make sure that your verification provider can handle verification of all types of accredited investor categories. Some verification providers, for example, only offer a connection to the IRS that enables them to pull the income figures directly from the IRS. However, that method only verifies US tax filers. It is unable to verify the income of foreigners or other persons that do not file tax returns. It only verifies one category of the many accredited investor categories. Further, if the investor is a joint couple, many of the verifications cannot be processed correctly. This method will not be able to accredit the majority of accredited investors. That’s just one example. Look for a provider that can handle all the accredited investor verification needs you expect to have.

What is the background of your founder or management team? Why did they start this company?

A company is only as good as its team. Look for a team that is experienced not just with the laws, but also with business transactions and capital raises. Look for a history of excellence and integrity. Check out their LinkedIn profiles, ask for references, and get a sense of why they started the company. Is their motive to conduct this type of business in a professional manner, or are they willing to throw ethics to the side in order to make money? Access to and review of sensitive financial or other information should only be trusted to those that can be trusted. Watch out for internet companies that are out to make a quick buck and take your business to professionally oriented companies. Beware the verification companies that have taken money from venture capital style investors, spent a lot of money on marketing while undercharging for their service in order to gain users, and are run by teams that have no real interest in securities laws, capital raising, or the verification space. Ask about the history of the business. Some of the verification providers in the space started out as internet companies doing a different business and then transitioned into the verification business only after the other business failed. Some verification providers built their product without a seasoned securities lawyer on their management team or even a seasoned businessperson. Avoid those companies and trust your business to a team that cares to do business the right way.

Do you have other products? What is your privacy policy? What protections have you built into your system to protect against possible security breaches? Who do you hire for your team? How many people have access to your database, and what controls do you put into place to monitor or restrict human access to sensitive files? What are some examples of how you have greater security than the next provider?

If a company has other products, beware. Make sure they are not taking user information and leveraging that information improperly to grow their other business. Many verification providers do not make much money on the verifications – however, they have other products that might be more profitable. These companies might have an incentive to cross-sell other products and/or utilize user information improperly. Ask about their privacy policies and their system security and don’t be satisfied with generic answers. Think critically about how they take security seriously and understand that it’s not enough for a system to be secure; policies to control the humans accessing and administering the system have to be robust. Many verification companies hastily threw up a product to try to make money – it’s your job to make sure that they paid enough attention to security issues.

Does your company have good financial health? How do you make money? How much do you spend? Are you profitable? How much money did you raise to fund your business? How long can your company last with the money you have left? Does your team depend on this company to earn a living?

These sound like invasive questions, and they are. The verification providers ask investors for sensitive information; why don’t you ask them some tough questions as well? Particularly in the verification space, there are a number of startups. Many of them are in poor financial health. Many of them raised a small amount of money from investors that force them to grow rapidly – as a result, many of them spent a lot of money to build their business while not making enough revenues to justify their spending. Many of them charge too little for their product in the hopes of winning the client first and making money later. That strategy doesn’t work in the verification space because the verification business is just getting started – high revenue growth and user activity hasn’t really materialized yet. For many of these startup companies, their future depends on their ability to raise more money – money that is not likely to come due to their lackluster performance growing the business. A number of verification companies have already gone out of business, and still some others are teetering on the brink of running out of money. Look for a company that has strong finances, a solid business plan, sensible product pricing, plenty of money in reserves, low expenses, and a small team that doesn’t depend on that company to earn a living. Otherwise, you might be doing business with a company that might be out of business soon or one that might take desperate steps to find revenues any way they can, even if it means jeopardizing the confidentiality of the user information they collect.

Who are the investors or backers of your company, if any? What do they expect from their investment? What did you promise them? Did you take any money from venture capitalists, angel investors, incubators, accelerators, or anyone else that demands supernatural returns?

Investors, especially venture capital style investors such as angel investors, incubators, accelerators, generally demand high growth and high returns. They’re looking for the next Facebook, not some boring cash flow business. That’s ok, but that’s a problem with the investor verification business. The market is actually pretty small – it makes for a good cash-flow business if leanly run, but it’s not a market that will ever be worth billions of dollars. The companies that took venture capital money will be under immense pressure to grow their business in ways that might be impossible in the verification space. To please these types of investors, these companies will either have to sell other products which might entice them to misuse the user information they’ve collected or take other desperate measures to grow aggressively. You don’t want to rely on a company that’s forced by its investors to conduct business in an unsound or unsafe manner just so it can deliver promised returns.

How is your customer service? Do you have a support hotline? How fast do you respond? Does your customer support team know enough about the laws and verification process to explain them? Can your customer support team identify with investors to explain why there is verification and walk them through the verification process? Does your team understand how the business of offerings work well enough to coordinate with issuers in helping them manage the verification process smoothly?

The verification business is new. The laws are complicated, and sometimes issuers (and even their attorneys) need some help properly integrating the verification process. Investors are even more skittish – many of them have invested in the past before just by filling out a questionnaire certifying themselves as accredited investors; they aren’t thrilled with the new verification rules and sometimes need some guidance through the process. Having a customer support team (not just the management team) that understands the verification space thoroughly will help smooth the transaction process and ensure that investors don’t drop off. Make sure that it’s easy to reach the verification provider and that they respond to inquiries very quickly.

Who uses you? Why do you think they used you? What feedback did they have? Do you have testimonials or references?

Ask for references. Get an understanding of who uses them, why they use them, and what their experiences might have been. Try to find a service that is used by issuers and investors as well as intermediaries such as portals, broker-dealers, and attorneys. In particular, see if they are winning the business of people that take compliance seriously, such as best-in-class portals, distinguished issuers or investors, broker-dealers, and prestigious law firms. Anyone that has friends can get a testimonial, so think critically who is providing that testimonial and understand the quality behind the testimonial. Look for testimonials from large, prestigious law firms and well-known companies who care about doing things right. Give less weight to testimonials from internet startups or portals that emphasis convenience and cost over quality.

Jor Law is a co-founder of Homeier & Law, P.C., where he practices corporate and securities law, including helping companies take advantage of alternative forms of capital raising such as Rule 506(c) offerings and crowdfunding. He is also a co-founder of VerifyInvestor.com www.VerifyInvestor.com, the resource for accredited investor verifications trusted by broker-dealers, law firms, companies, and investors that insist on safety and reliability.