Starting May 22nd, 2021 FINRA will require Issuer to fill out an update form when filing. The new rules are based on FINRA Rules 5122 (Private Placements of Securities Issued by Members) and 5123 (Private Placements of Securities). It is very important for Issuers to familiarize themselves with the changes in order to stay compliant with the new and updated questions that are in the new Filer Form. As the new Filer Form will be required for all new filings as well as amended ones, May 22nd is a major day for all Issuers. The full breakdown of the form changes, including the actual form, and contact information for sending FINRA inquiries regarding the changes can be found on FINRA website. That being said we will summarize the announcement in this blog article.

Read More

The Division of Examinations (formerly the Office of Compliance Inspections and Examinations) has announced in a recent Security and Exchange Commission press release plans to continue their focus on the potential risks of digital assets. The SEC taking the digital asset category seriously lends legitimacy to that industry and hopeful is a prelude to a more robust digital asset industry in the United States. In the short term, however, the Division of Examinations intends this study to be used in regulation and transparency for companies and investors looking to use digital assets more in their investments and funds.

Read More

SEBI, or Securities and Exchange Board of India, is considering the addition of the accredited investor to the regulations. The agency is reaching out for public comment in order to get a good understanding of how industry professionals and investors feel about the concept of adding an accredited investor definition to Indian securities law. The accredited investor definition has had great success throughout the world. Many international accredited investors boost their respective countries’ economies, so it is no wonder that India is considering adding this definition to its securities regulations.

Read More

In 2020, the value of cryptocurrencies rose dramatically, driven in part by greater institutional acceptance and bitcoin buying. As a result, VerifyInvestor.com has noticed an uptick in investors qualifying as accredited investors due to the value of their cryptocurrency holdings. Whether people hold their cryptocurrencies on an exchange or a wallet, they can use crypto to get verified as accredited investors. Regulation D allows verified accredited investors to participate in private deals similar to those conducted by Filecoin, Hashgraph, and tZERO.

Read More

Sometimes it seems the financial system in the United States is playing catch up with other industries. The finance industry desperately needs to modernize between old traditions and practices, slow bureaucratic lawmaking, and an unwillingness to adapt to modern technology. The incredible accessibility that 21st-century technology has afforded the world brings with it changes in literally every corner of every industry. For investing, this means embracing same-day settlements on trades. Let us examine how trade settlements work and why same-day settlements have become a hot topic.

Read More

As a new presidential administration enters the fold and as the confirmation of a new Head of the SEC takes place, let us look at the outgoing SEC head Jay Clayton’s accomplishments. After serving from 2017 to 2020, Clayton’s SEC accomplishments are countless; we will focus on the many important things that occurred during his tenure, mainly focusing on Rule 506(c) changes and how that has changed our industry.

Read More

When viewing the words accredited investor and sophisticated investor side-by-side, the average person may think these are the same terms or hold practically the same meaning. Financial professionals often use these terms interchangeably to their detriment. Understanding the difference between an accredited investor and a sophisticated investor is paramount to avoiding serious consequences. Unfortunately, a simple slip up of vocabulary, in this case, can lead to worse situations than a simple misunderstanding. This blog will describe why it is essential to understand the difference between an accredited investor and a sophisticated investor.

Read More

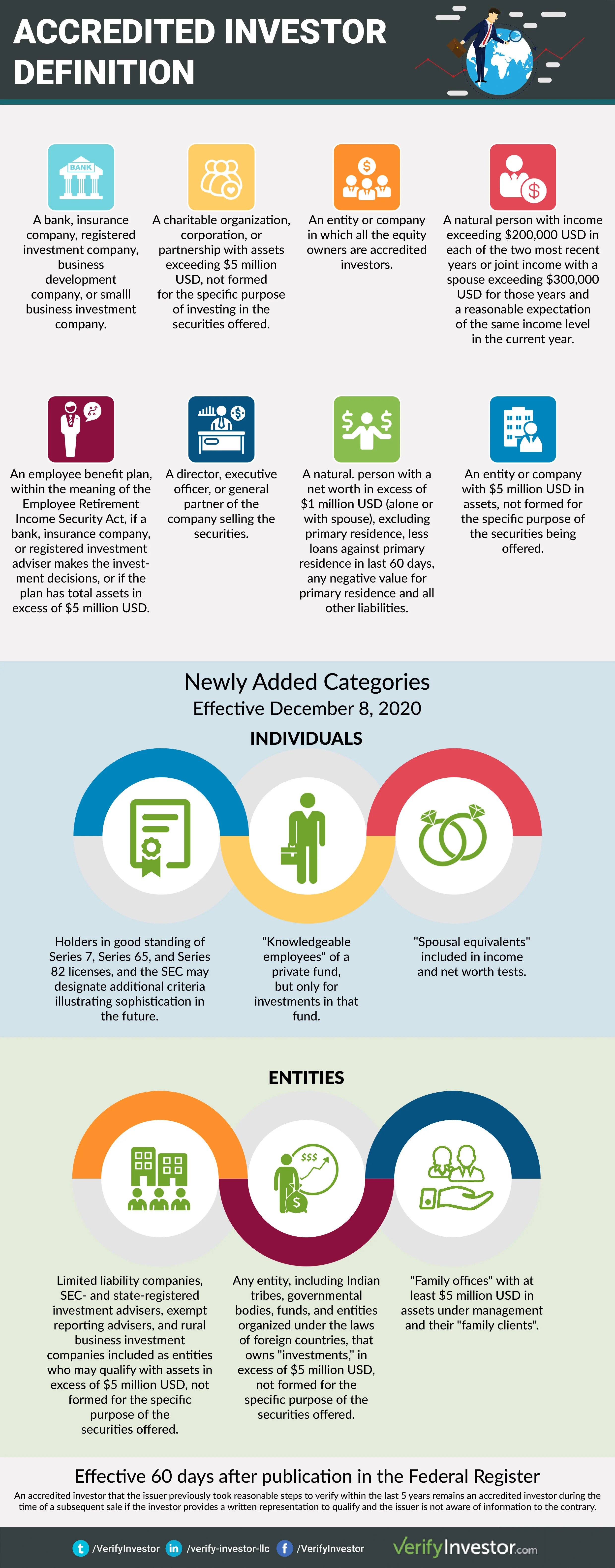

Real estate syndication just got more comfortable with the passage of new accredited investor definitions by the SEC on December 8th, 2020. For years, the SEC has danced around the idea of adding new definitions, thereby potentially increasing the available pool of accredited investors for issuers of Rule 506(c) offerings. After many open forums and discussions, the SEC added definitions that industry leaders have lobbied for many years. Let us discuss how these new changes will benefit real estate issuers and investors alike.

Read More

2020 was a year like no other in our lifetime. Sadly, the COVID-19 pandemic has wreaked havoc all across the globe, bringing shutdowns, unemployment, and other tremendous challenges that fell particularly hard on small businesses and families. Financially speaking, The Federal Reserve has taken some serious action to combat the virus’s heavy economic toll, as have governments worldwide. Now, as the year concludes, yet another $900 billion USD stimulus package is in the works in the U.S. Let us take a closer look at this whirlwind of a year.

Read More