When viewing the words accredited investor and sophisticated investor side-by-side, the average person may think these are the same terms or hold practically the same meaning. Financial professionals often use these terms interchangeably to their detriment. Understanding the difference between an accredited investor and a sophisticated investor is paramount to avoiding serious consequences. Unfortunately, a simple slip up of vocabulary, in this case, can lead to worse situations than a simple misunderstanding. This blog will describe why it is essential to understand the difference between an accredited investor and a sophisticated investor.

Read More

Real estate syndication just got more comfortable with the passage of new accredited investor definitions by the SEC on December 8th, 2020. For years, the SEC has danced around the idea of adding new definitions, thereby potentially increasing the available pool of accredited investors for issuers of Rule 506(c) offerings. After many open forums and discussions, the SEC added definitions that industry leaders have lobbied for many years. Let us discuss how these new changes will benefit real estate issuers and investors alike.

Read More

2020 was a year like no other in our lifetime. Sadly, the COVID-19 pandemic has wreaked havoc all across the globe, bringing shutdowns, unemployment, and other tremendous challenges that fell particularly hard on small businesses and families. Financially speaking, The Federal Reserve has taken some serious action to combat the virus’s heavy economic toll, as have governments worldwide. Now, as the year concludes, yet another $900 billion USD stimulus package is in the works in the U.S. Let us take a closer look at this whirlwind of a year.

Read More

Let's face it: venture capitalism is not for the faint of heart. Instead, it's so cutthroat that most venture capital funds fail. That's why the more successful venture capitalists tend to focus on allying themselves with the best firms and investing in the entrepreneurial diamonds in the rough. To that end, we’ve compiled five simple, straightforward tips for up-and-coming venture capitalists. Of course, venture capital is much more nuanced than essential advice can provide; however, think of these as a solid bedrock of everyday things to keep in mind.

Read More

In part one of this series, we discussed the SEC’s newly adopted amendments that fill in some important gaps in existing private placement laws while simplifying and improving consistency to improve transparency for issuers and investors alike. These amendments will take effect on January 2021, which is just around the corner. We reviewed changes to Regulation A and Regulation Crowdfunding, as well as non-exclusive safe harbors from integration. Now, let us examine additional key changes to Rule 504 of Regulation D, “Test-the-Waters” and “Demo Day” communications, eligibility requirements, and improvements to other SEC registration exemptions.

Read More

It’s common knowledge that growing small businesses and startups do not always have the crucial resources at their disposal to participate in the traditional securities registration process. Therefore, they tend to choose from among several registration exemptions offered by the Securities and Exchange Commission (SEC). On November 2, 2020, the SEC adopted amendments that simplify existing laws, enhance their consistency, and fill in gaps. The amendments take effect 60 days after their date of publication in the Federal Register.

Let’s take a look at a few of the highlights: changes to Regulation A, changes to Regulation Crowdfunding, and non-exclusive safe harbors from integration.

Read More

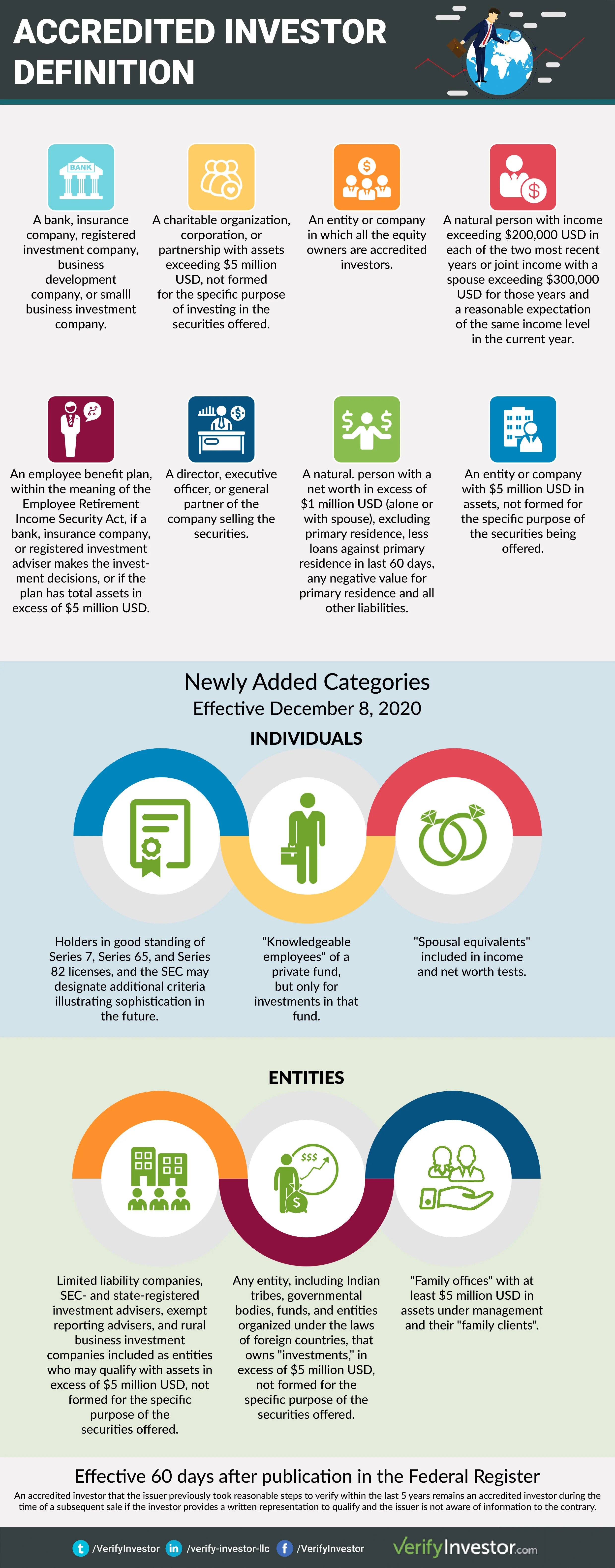

Traditionally, most people have been unable to invest in the private placement market because alternative investments have generally been reserved for those considered by regulators to be wealthy enough to bear the risks. Such qualified entities and individuals, known as accredited investors, feed much-needed capital into the private placement market by participating in publicly solicited offerings such as Rule 506(c). Now, after 35 years of largely unchanged rules that qualify the investors in many private placement offerings, the U.S. Securities and Exchange Commission (SEC) has expanded the definitions of “accredited investor” and “qualified institutional buyer.” Adopted on August 26, 2020 and taking effect December 8th, 2020, the final rules add new investor categories that reflect the "financial sophistication" level of various individuals and institutions. We will now discuss more about these new amendments and how they may affect you, either as an issuer or an investor.

Read More

Raising small business capital has never been a simple process, and smaller issuers have relied largely on their networks to make it happen. That’s why the Securities and Exchange Commission (SEC) recently proposed rules that would allow natural persons called “finders” to accept compensation from issuers of SEC registration-exempt offerings as they seek to raise funds from accredited investors. Typically, such finders need to register as brokers under Section 15(a) of the Exchange Act, but the newly proposed rules would exempt them from this requirement under certain limited circumstances.

Read More